Pay rate calculator qld

Opening and closing the business. Your weekly compensation payments are based on the wages you received from your current employer in the 12 months before your injury.

Payroll Tax Deductions Business Queensland

ATO fortnightly tax deductions -.

. Tax payable 1300 Example 2 Total taxable value of 6400000 Tax band is 50000009999999 Tax calculation 62500 175 cents 1400000 excess. Total Queensland taxable wages - Deduction Payroll tax rate. Some employees may be entitled to a higher pay rate for working at particular times of the day or on certain days of the week.

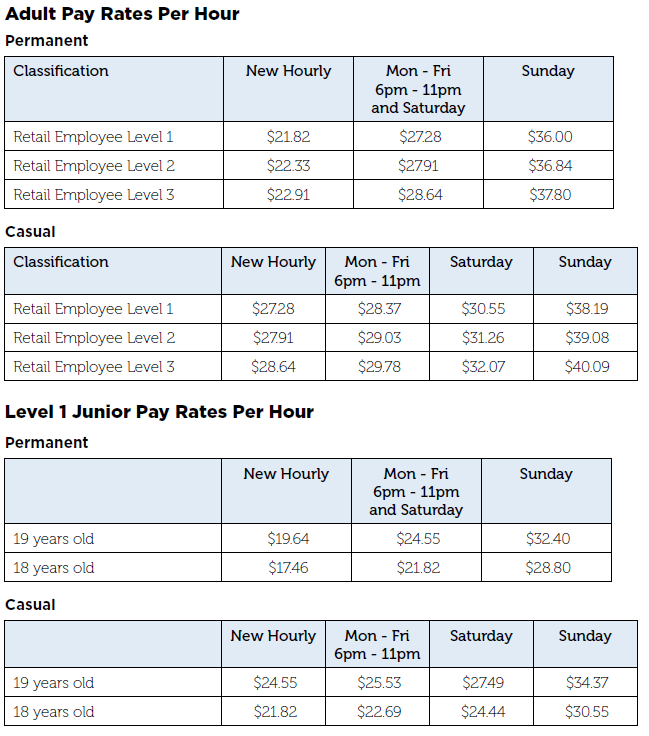

Learn about workplace entitlements and obligations for sick and carers leave COVID-19 vaccinations PCR and rapid antigen testing and more. As of 1 July 2022 the National Minimum Wage is 2138 per hour or 81260 per week. This calculator is always up to date and conforms to official Australian Tax Office.

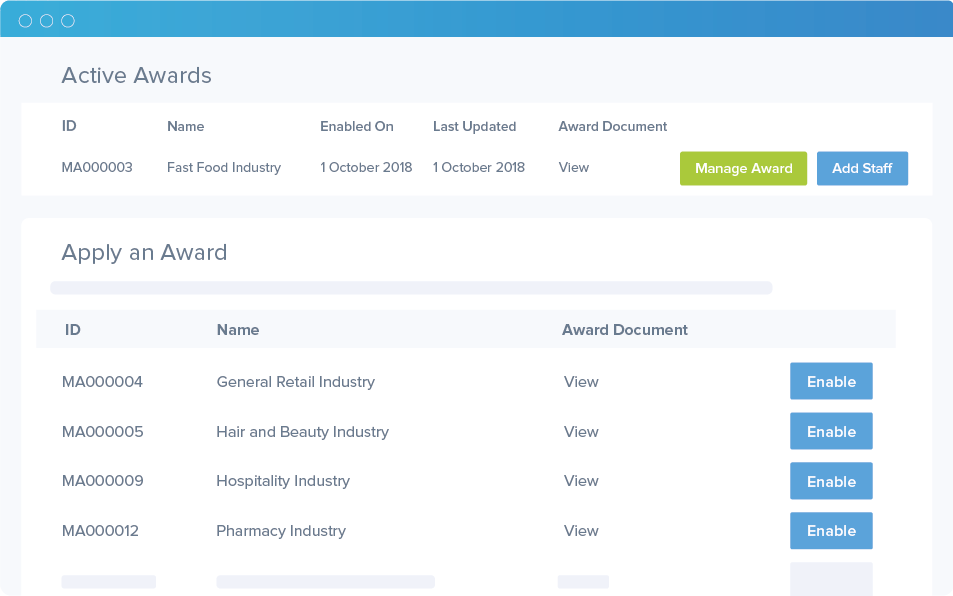

The Shift Calculator can only be used once you have completed the Pay Calculator and have a minimum pay rate to. Employees covered by an award or registered agreement are entitled to the minimum pay. Highest paying cities in Queensland for Cleaners.

Payroll tax calculators You can use our calculators to determine how much payroll tax you need to pay. The Australian salary calculator for 202223 Hourly Tax. Calculating normal weekly earnings.

Employees need to be paid the right pay rate for all time worked including time spent. Use Our Calculator See How Much You Could Save Today. Australia Hourly Tax Calculator.

Check to see if you are covered by an. Using the PACT pay calculator tool. 475 for employers or groups of employers who pay 65 million or less in Australian taxable wages.

You have been redirected here from the Shift Calculator. Oncosts are the additional costs above the annual salary incurred in employing someone to fill a position or undertake a role. Take home pay 656k.

What are the most common pay calculations in QLD. Working on a weekend or. The Hourly salary calculator for Australia.

Your salary - Superannuation is paid additionally by employer. Ad Calculate Your Savings Using Our Salary Sacrifice Calculator. The national minimum wage sets out the lowest rate of pay for private sector employees not.

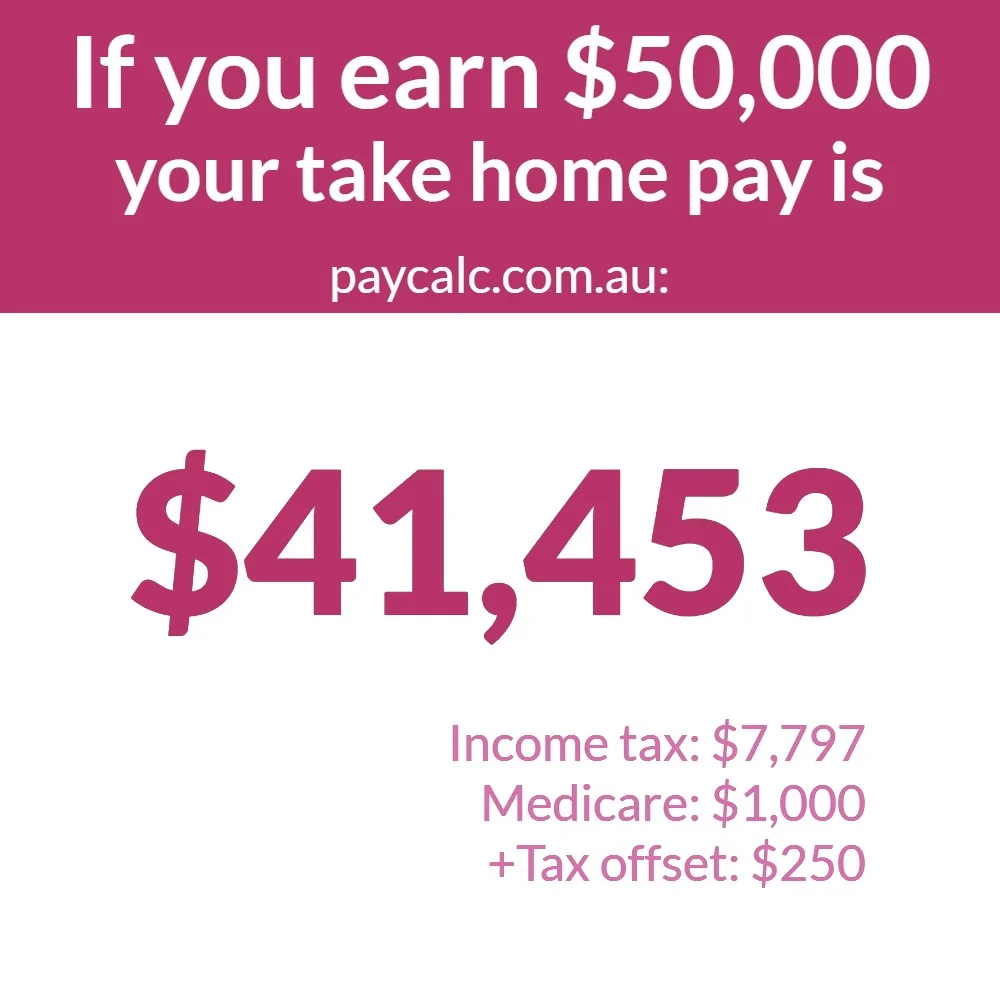

Once again if your employer uses ATO tax tables to calculate your pay you will be overpaying 67 in tax if you earn 87000 per year and getting paid fortnightly. Calculate your liability for periodic annual and final returns and any unpaid. Use this calculator to quickly estimate how much tax you will need to pay on your income.

The payroll tax rate is. Brisbane influenced data the most obviously but heres the most popular pay calculations in Queensland last year. Pay rate doesnt look right.

After 6pm Monday to Friday. 495 for employers or groups of employers who pay more than. This salary and pay calculator.

Social Community Home Care and Disability Services Industry Award MA000100 Pay Guide For employees in Queensland whose employers are non-constitutional corporations use our. Contacting the Fair Work Ombudsman on 13 13 94. Enter your Hourly salary and click calculate.

You can work out how much payroll tax you need to pay that is your payroll tax liability by using this formula.

How Much Should I Charge As A Consultant In Australia

P A C T Pay Calculator Find Your Award V0 1 108

Ytd Calculator And What Is Year To Date Income Calculator

How To Calculate Taxes On Payroll Shop 56 Off Www Ingeniovirtual Com

Nurse Salary What Do Nurses Earn Healthtimes

Queensland Health Hourly Pay In Australia Payscale

Hospitality Award Rates Complete Guide 2022 Tanda Au

Aus Processing State Payroll Taxes For Australia

Payroll Tax The Hidden Risks Of Interstate Employees Hlb Mann Judd

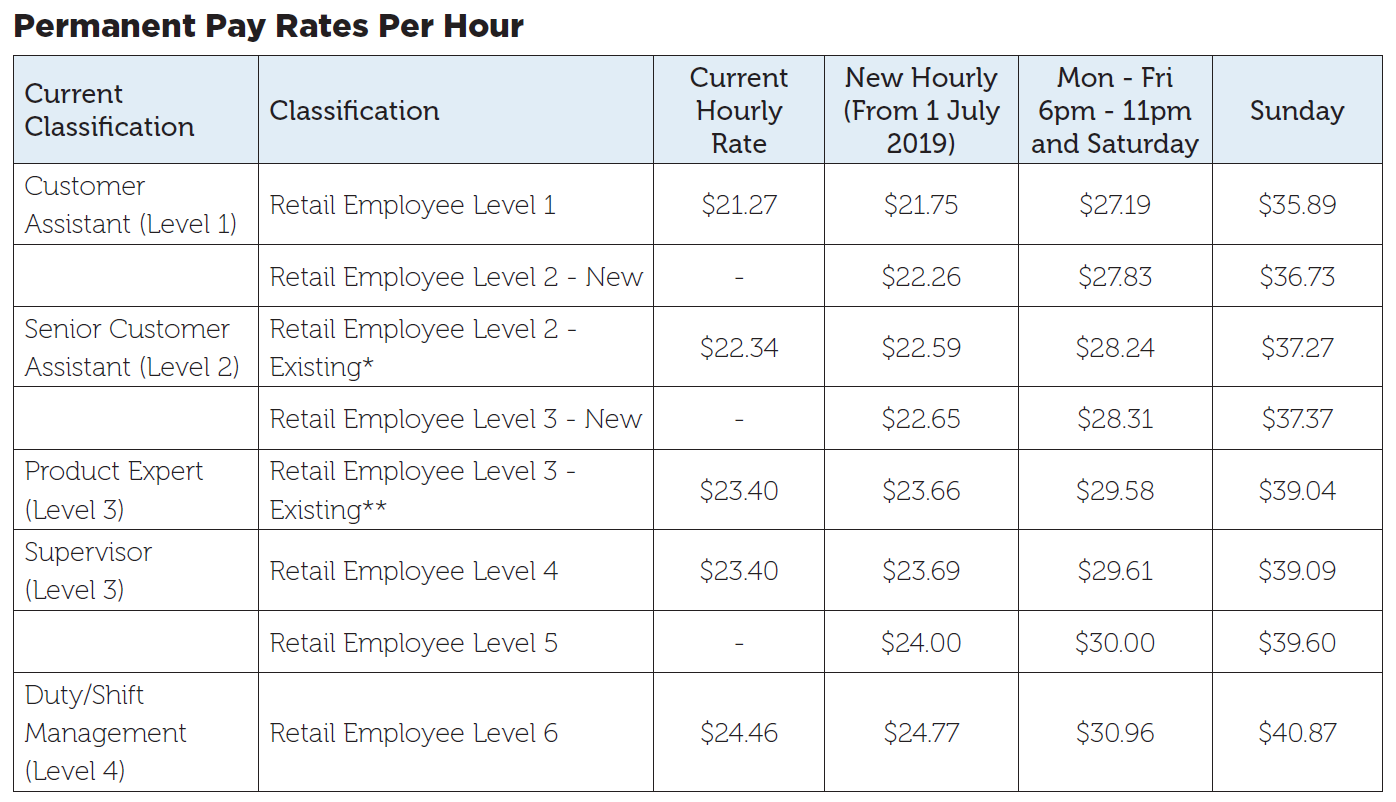

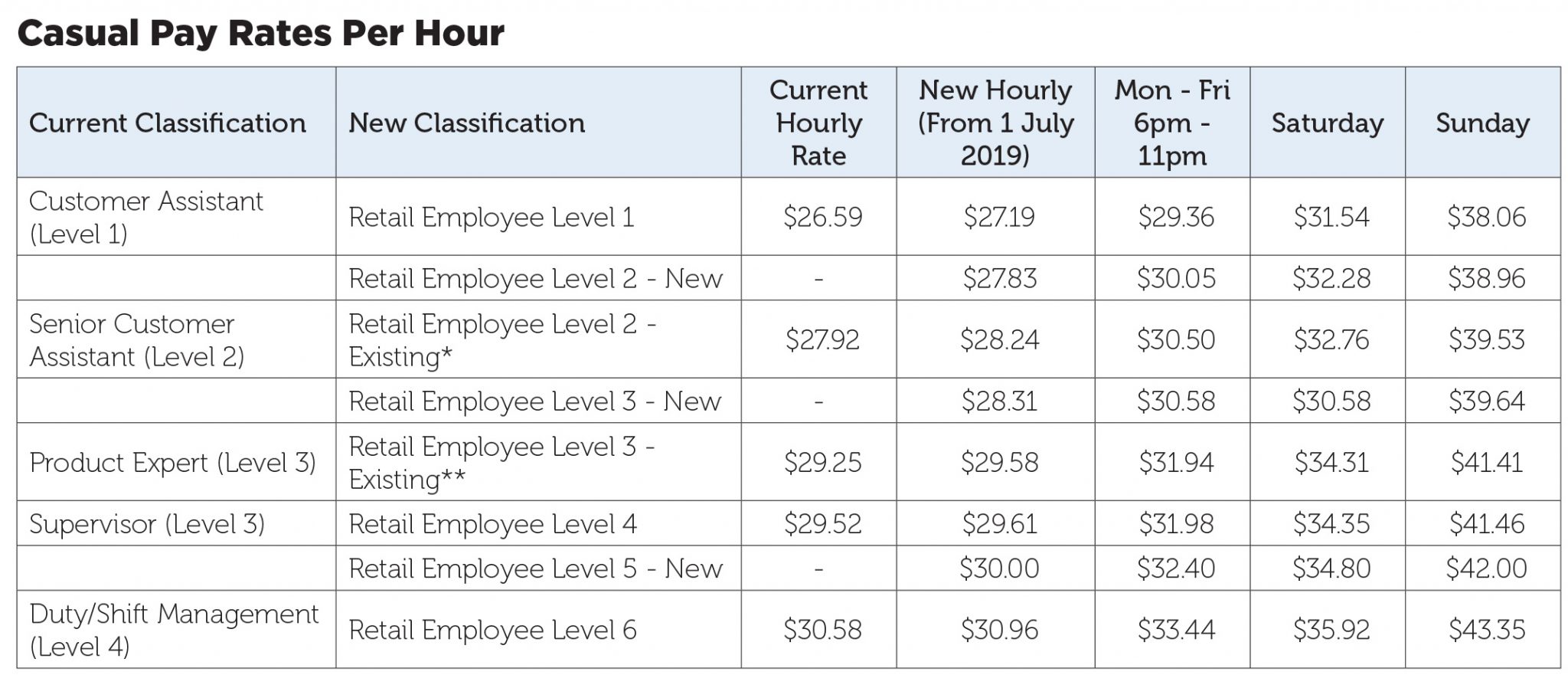

Proposed Dan Murphy S Agreement 2019 Sda Union

Guide Printing Business And Industry Queensland Government

Proposed Dan Murphy S Agreement 2019 Sda Union

Aus Processing State Payroll Taxes For Australia

How To Calculate Taxes On Payroll Discount 57 Off Www Ingeniovirtual Com

Pay Calculator

Bws Agreement 2019 Sda Union

2